Hence, the employer deposits this collected tax to the IT Department.

TDS is the income tax that an employer deducts from the salary of the employee. Professional Tax is a tax that a government levies on professionals based on their salary/monthly income. Employee contribution to PF and EPS will be deducted from the salary. But it will be added to the salary breakup report. The employer contribution to PF and ESI is not a part of the take-home salary. DeductionsĮmployee Deductions are the amounts subtracted from an employee’s gross pay to reach net pay. If there are any kind of reimbursements, you need to add them to the gross pay. Hence, Basic + Allowances = Gross Salary. These allowances differ based on company policy, industry, job profile, and department.īasic Salary along with the allowances forms your Gross Salary. AllowancesĪllowances are the financial benefits an employer provides above the Basic Salary to his employees. These components include Annual Gratuity, Employee Contribution to Provident Fund or ESIC are determined according to your basic. Other components of your total pay are calculated depending on your basic pay. Basic Salaryīasic salary is the fixed amount that an employer pays to an employee without adding any allowances or subtracting any deductions. Bonuses, overtime, dearness allowance, etc are not a part of basic pay. Source: There are 3 major components of Salary: Basic Salary, Allowances, and Deductions. Extract the monthly totals of each component and insert it in the yearly breakup report. Hence, first of all, we need monthly Salary Sheets for the past months.Įach salary sheet bifurcates the paid and unpaid compensations. To prepare a Salary Breakup Report, historical data will be required. Moreover, this further helps the management to makes necessary changes to their pay structure to improvise employee retention. This bifurcation helps the employer to understand the percentage of the compensation they are paying against their income as well as sales turnover. The main purpose of preparing a salary breakup report is to know the amount of compensation paid under each head. It bifurcates the amount a company pays against basic, DA, HRA, etc. In simple terms, it is the bifurcation of salary a company pays to its employees. It also includes deductions like Contribution to provident fund, profession tax, TDS, Advance Salary, etc. It includes heads like basic salary, DA, HRA, Conveyance, medical, special allowance, bonus, TA, etc.

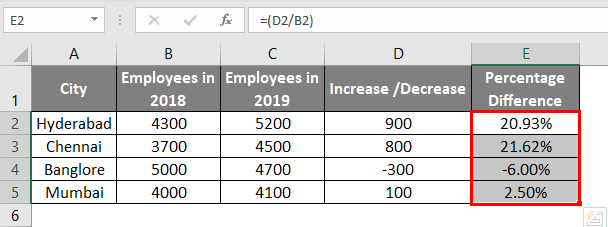

Salary breakup is the detailed statement total compensation paid to all employees during a specific period of time.

0 kommentar(er)

0 kommentar(er)